With the war in Ukraine still ongoing, sanctions have continued to increase over the last week, all to try to stop the fighting.

There are designed to be hard-hitting for Russia, however, none of this of course is without consequence here. This week I thought I would take a look at this, what this could mean for us and how we should get ready.

Taking a step back

Only 2 weeks ago, before all this started, there was already plenty of concern about a potential cost of living crisis in the UK.

Natural gas prices were spiking due to winter demand and low supply over the winter and this had already had fallout in the energy sector. Many energy suppliers ceased trading, forcing customers onto standard tariffs… standard tariffs that are due to increase by 53% for the average household in April.

A 53% increase in energy costs is significant for most people, many businesses and adds further stress to cash flow. Cash flow that may already be stretched by the COVID pandemic and supply chain issues, both globally and due to Brexit.

And now Ukraine

Against all this backdrop, we now have the invasion of Ukraine, with associated sanctions, which is now adding a further shock to the system.

Natural gas, the source of much of the heating and electricity generation in the UK has hit another record high. It is now 6-7x the long-run average, much of which has yet to be factored into the price caps domestically.

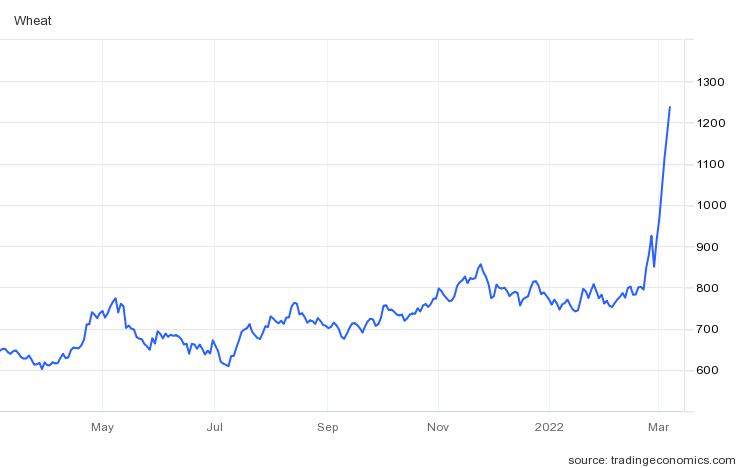

Wheat, a proxy for base food costs, is not much better, with so much production for Europe from Ukraine and Russia, future supply shortages has forced the price to record highs too… and of course, energy is involved in food production and distribution too… food costs will be up.

And, whilst these are scary graphs, I feel I do need to point out that all of this is a lot less scary than what the folks in Ukraine are facing these days… what we really need is for the invasion and fighting to stop as soon as possible.

Economic impacts

This being said, and should nothing change, we also need to prepare to manage significant impacts should this flow through to the global economy.

Food shortage may lead to civil unrest, energy shortages to further conflict and extended sanctions to a more permanent dislocation of the global economy and its integrated supply chains. All of this adds to the inflationary cycle, pushing prices up, companies out of business and affordability down, beyond what we have seen through the COVID pandemic.

In collections/receivable processes, this could result in a massive wave of arrears volumes flowing through, as customers struggle to make existing payments and commitments.

What to think about now?

There is of course the possibility that governments will step in to help mitigate some of this, and the situation may improve as quickly as it seems to have arisen.

However, should nothing change, by the end of the summer we could start to see this impact and now is the time to get prepared for increased volumes in collections… I have added some thoughts on this below.

- Use digital processes to reduce the cost of simple or repetitive tasks. Lean on digital transformation to free up resource for use elsewhere in more complex processes (such as handling difficult customer situations)

- Consider investing now, don’t delay. If inflation takes hold and prices do increase, you are better paying for infrastructure now, rather than waiting when we are in the middle of a crisis and may not have the revenue to afford it.

- Understand and plan your capacity plan. Post-digital transformation, understand and plan your capacity requirements. How will these be met? What will trigger hiring, What is the ramp up time? and how is this impacted by different scenarios? Stress test your plans

- Review your financial difficulty and vulnerable policies. With so many customers in potentially difficult situations make sure you have your forbearance tools, procedures and vulnerable customer management processs in place to help support. A customer helped here, if done well, can afterall be a customer for life.

- Don’t forget reporting and control. Invest in monitoring and MI. This is critical to understand when something has changes, when to trigger your plan, map impacts on your business and its profitability. Early development here can provide early insight and help avoid an awful lot of difficult decisions later on.

- Lastly, remember your team. Your employees may also go through a hard time with this personally too. Have a plan, be proactive and make sure they are supported too. You will need all the help you can get if things get tough.

With so much going on, it can sometimes be hard to think proactively and take control. Just waiting to see what happens seems easier, but can lose you time and cost more money (as we saw with those that were not ready with the flexibility needed during the early days of the COVID pandemic).

It has likely been at least 40 years, if not longer, that we have ever seen price increases as we have in the last 2 weeks. Some of this speaks to our global interconnectedness but also points to the importance of being prepared. A bit of thought now, while we have time, for modest cost, could save an awful lot of effort later on.

In the meantime, if you, like me, are watching the news and twitter constantly, let’s just hope the conflict is over soon and everyone gets to go safely home soon.