From on ro-ar.com

This week seemed a week of reflection. Attending a few of webinars it seems a few of us were in the same mode too.

The spurt of activity post-Christmas seems to have waned, investment-ready, but the button to start is not being pressed.

It is busy busy rather than delivery busy.

Economically it is becoming increasingly evident a pent-up demand for spending and for lending is building. Some consumers are revving their shopping engines, ready to go, just waiting for the brakes to be released.

This of course could somewhat be behind any pause in collections-related investment activity. Financial services businesses could simply be directing funding elsewhere in anticipation of generating growth.

Of course, as discussed last week, we are not out of the woods yet. There is still a substantial proportion of society on furlough and the very real risk of rising unemployment.

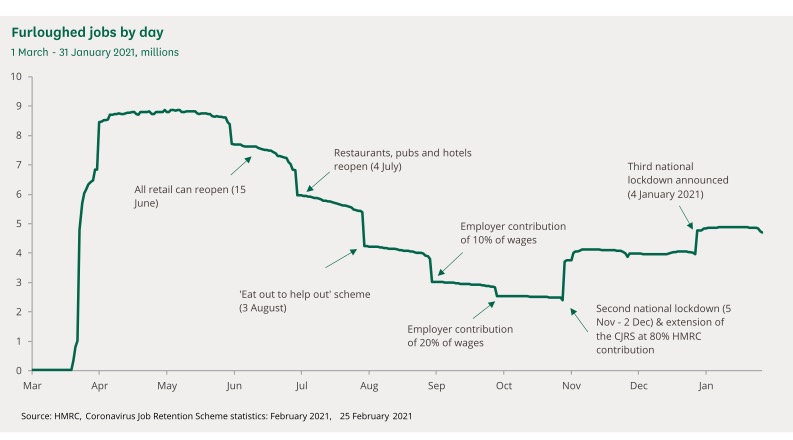

This was further highlighted, this week, in the government report on the scheme. It also contained a very illustrative graphic, detailing just how numbers rose, fell and are now on the rise again. What is also worth noting is that this time the numbers are rising at exactly the same time the unemployment rate is increasing too. Something we have not seen to date, so really does seem different this time too.

Lastly, as if to illustrate the point, a study from Ofcom this week showing that 4.7million customers struggled with their Telco bill over the last year too.

Even though lockdowns are starting to relax and things are feeling more optimistic, we need to continue investment and process preparation. Remaining vigilant and focused on spotting is clearly going to remain important.

A couple of other stories this week too

- Millions of UK bank customers miss out on security checks – also against a background of increased fraud activity during lockdown

- UK office workers would give up promotions, benefits and pay increases to work from home – more desire for working from home continues

- Nationwide tells 13,000 staff to ‘work anywhere’ – seems like Nationwide are already moving in this direction

- Mind the gaps: will we go back to public transport after Covid? – with public transport struggling as a result?

- Half of British workers had real-terms pay cut in 2020, study says – however will this also have long-term impacts on pay structure too?

Have a good weekend everyone…