Listening to the common narrative these days we hear a lot about being in the era of ‘fake news‘.

Listening to the common narrative these days we hear a lot about being in the era of ‘fake news‘.

Whilst undoubtedly there is some ‘made up news’ around, much of the conversation online seems to be spent arguing about stories with selective use of facts and heavily influenced by personal opinion bias.

Even in what would be considered mainstream media it sometimes feels we have a battle of ‘fake news‘ vs ‘fake news‘, with audiences simply agreeing with the outlet that most confirms their own opinion.

One only has to look at the comments section in news reports to see the arguments rage. Facts and balance seems to quickly get pushed out of the discussion after a few comments. They frequently degrade to the hurling of insults.

Data rich, time poor

This is frustrating, and somewhat ironic that it is happening in an era where there is more information readily available than ever before.

In many ways, our challenge is not getting the facts, but getting the time to review the data, consider it and form our own opinion. In a time challenged world, it is all too easy to look for shortcuts and as a consequence be influenced other peoples opinion, not form your own.

Bank of England

A good example is the data from the Bank of England. There are a couple of reports that are always worth a read.

- Credit Conditions Review : A BoE commentary on the latest statistics, usually with interesting data

- Credit Conditions Survey : A survey of bankers and lenders on what they are seeing in their business

- Agents summary of business conditions : A survey of businesses and business sentiment across the UK – one of my favourites

They often contain interesting data and insight, the pieces just need fitting together.

The latest set of publications is no different and tell an interesting story.

The ‘lets go shopping’ economy

Post EU-Brexit vote, the population collectively seems to have decided… ‘let’s go shopping’.

Maybe it was buying now in anticipation of prices going up, or for others just a sense of empowerment spilling over into retail purchases. Either way the reaction has been one of retail therapy, generating a boost to the economy.

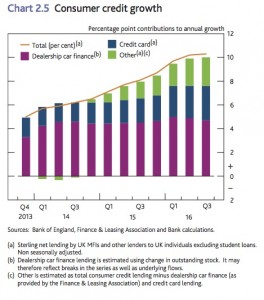

However, looking deeper, this appears to be being fuelled by an expansion of consumer borrowing.

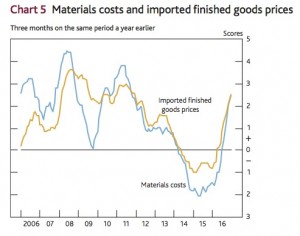

Even more concerning is the extent to which material prices are going up. We may not have felt this at the supermarket yet (although it did seem like there was less tea in my tea bag this morning, and my chocolate bar is smaller…!), however it appears there is something on its way.

Pipeline risks

Pulling this all together it feels there are a few key risks in the pipeline.

- Significant inflationary pressure, reducing disposable income

- Increased consumer debt load, increasing sensitivity to any increase in interest rates

- A weakening pound, making UK assets of more interest to foreign buyers, reducing the number of UK lead firms (and less sensitivity to the UK market).

Undoubtedly an unusual set of dynamics at play here and despite a relatively benign environment the last few years, it appears the data is showing a change.

Now is the time to get ready, and have a strategy.

Freedom to form your own opinion

The BoE data is interesting, and this is at least is my opinion….!

By all means listen to others, however be it Economics, Climate Change, Government spending or a subject of your choosing, it is well worth finding the time to source the data, keep an open mind and form your own opinion.

In the current environment that is a very valuable commodity indeed.

….

BoE data and graphs below, to help form your own view..!

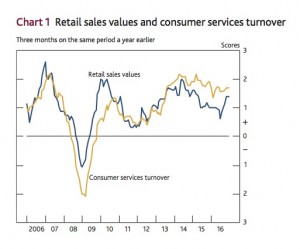

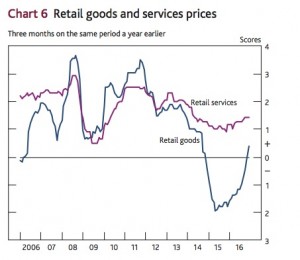

Retail Confidence has been up – Confidence shopping

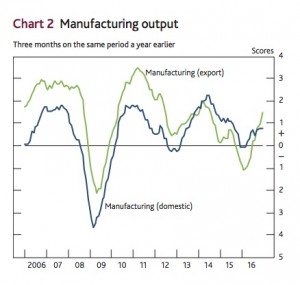

This, together with the weakness in the pound, has helped drive manufacturing demand.

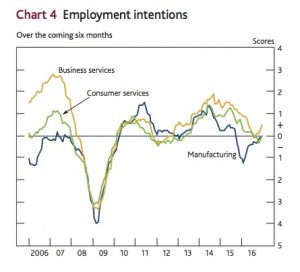

…and this ‘confidence’ is spilling over to hiring intentions and ‘potential’ for new jobs.

…and this ‘confidence’ is spilling over to hiring intentions and ‘potential’ for new jobs.

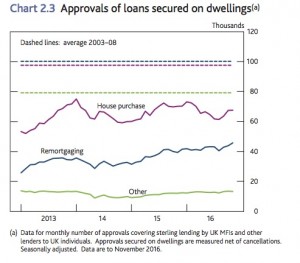

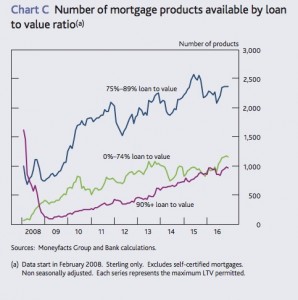

However…. in order to fuel this spending we have been borrowing more, with the industry lending more (including higher LTV lending)

However…. in order to fuel this spending we have been borrowing more, with the industry lending more (including higher LTV lending)

Credit Cards

Motor finance

…. yet…. all the while underlying input prices are going up.

(all data BoE from datasources linked above)